U.S. Stock Markets Continue: The Week Ahead, 5 June

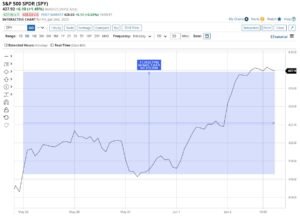

The SPY Friday closed up +1.45%, and the QQQ closed up +0.73%. For the week the SPY was up 2.7% and the QQQ up 3.4%. As the saying goes, stocks lead earnings and earnings lead the economy. You would have to be a brave investor to bet against this U.S. stocks.

Despite continued predications about a possible recession, U.S. stock markets continue to move higher. Yes, it is a concentrated market with seven stocks dominating the increase in market cap, YTD. More on this later. The week closed with the S&P 500 at a nine-month high, and the Nasdaq 100 is approaching a 14-month high.

A RECESSION, IT IS A LONG WAY OFF

The U.S economy remains strong, the May nonfarm payrolls increasing +339,000 above expectations. In the U.S. May average hourly earnings eased to +4.3% yoy. The question is how will this impact the Fed. The market expects a +25 bp rate hike at the June 13-14 FOMC meeting.

Stocks opened with the good news that the U.S. Senate passed legislation to suspend the debt ceiling. Global bond yields on Friday moved higher. The 10-year T-note yield rose to 3.70%. The 10-year German bund yield rose to 2.31%, and the UK 10-year gilt yield rose to 4.15%.

THE WEEK AHEAD

The focus this week will be on OPEC+ deals with a divided oil market. A range of Apple products will debut at Apple’s Worldwide Developers Conference.

DISH Network finished up more than 16%. Amazon announced that it is in talks to sell mobile phone service to its U.S. prime subscribers. Lululemon Athletica finished up more than 11%. The Group posted Q1 net revenue that exceeded expectations. Management upgraded its 2024 net revenue target. The 3M stock up more than 8% on Friday.

There is continued momentum behind these markets. Key technical studies on the S&P 500 graph, are indicating over bought. These are the Bollinger Bands the MACD and the RSI. Certainly the stock markets continue higher due to the Magnificant Seven. The stock market could broaden as recession fears reside. Further if at the next earnings, earnings are upgraded by companies into 2024. Seriously, watch this space.

The Euro Stoxx 50 finished the day up 1.55%. The Shanghai Composite closed up 0.79%, and the Nikkei Stock Index in Japan closed up 1.21 percent.

Traders from all around the world use online trading to benefit from the world’s largest and most liquid markets, trading up to $6 Trillion per day.

Due to innovations in technology investors and traders can now invest in a range of securities. Forex, Commodities, Energies, Indices & Stocks, easily to trade with FX PRIMUS at the click of a button.

The AI boom accelerates

THE SEVEN TECH LEADERS

Take a look at how you can use technical indicators to improve your investing, click HERE.

Subscribe to

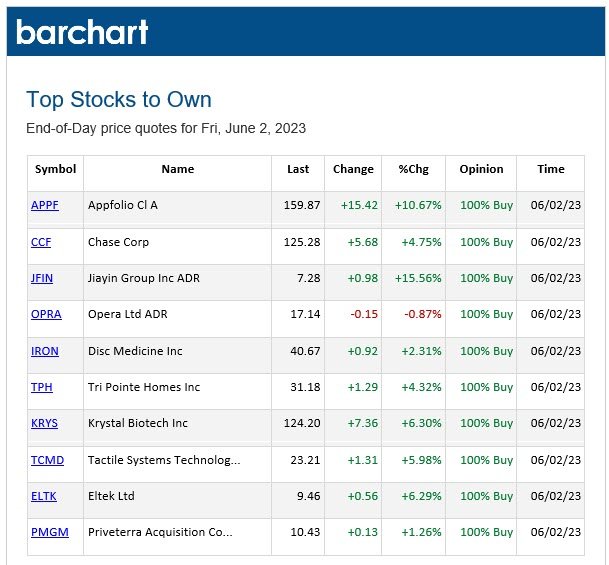

BARCHART: IDEAS FOR STOCKS AND ETFS TO CONSIDER

STOCKS

AppFolio, Inc. provides cloud-based software solutions for the real estate and legal industries. Property Manager, including posting and tracking tenant vacancies. It conducts the full leasing process, administering maintenance and repairs.

ETFS

PRICE SURPRISES AND VOLATILITY

For 2 June . Barchart lists Price Surprises both upside and downside. This is for volatile stocks, as indicated by standard deviation compared to their past 20 days of data.

STOCK PERFORMANCE LEADERS AND LAGGARS

The stocks that led and lagged the stock market.

https://www.barchart.com/stocks/performance/percent-change/advances?viewName=148911

PLEASE CLICK THE LINK TO THE DISCLAIMER

![]()

The charts used in this Blog Post are from Barchart. Barchart is a financial data and technology company that provides financial market data, news, analysis, and trading solutions. The website is designed for individual traders and investors, as well as institutional clients, including banks, brokers, and hedge funds.