Focus on High Dividend Yielding Stocks as an Investment Strategy

Have you ever wondered how to search and select high Dividend Yielding Stock?

Do the Quiz, click HERE.

How to search and screen for High Dividend Yielding stocks?

How to understanding if your Dividend is at risk?

In this article I am going to cover the Investment Strategy focusing on Dividend Yielding stocks.

Why are Dividends, important to some investors?

Let’s focus on Dividends in particular the payment of a Cash Dividend. Remember Dividends can be presented to Shareholders in different forms, Cash, or a Dividend Reinvestment Plan. so First and foremost, make sure you understand how the forthcoming Dividend is being offered.

In the current Macro Economic environment being High Inflation, rising Interest Rates and the risk of a recession. Investors could be best served by considering higher-quality companies that offer solid dividend yields as a hedge in this current economic scenario. High Dividend Yielding Stocks could act as a Hedge considering the current uncertainty surrounding inflation. Inflationary pressures are expected to continue, the FED become more hawkish leading to a possible weakness in Stocks.

Stock Investors should consider High-Yielding Dividend Stocks to mitigate this risk

At this point in time High Inflation is dominating the dialogue among Investment Professionals and Stock Market Commentators in the media.

But what if all the current rate hikes by the Federal Reserve causes disinflation?

Even if this scenario is a long way off, the risk of Price uncertainty or instability, Inflation or Deflation is what divided paying stocks can, to some extent mitigate this risk. Consider this, the U.S. economy is experiencing a slowdown in growth, but there has been better-than-expected jobs reports with around 517k jobs created in January. Job growth was widespread across the broad economy, gains in job creation was led by in leisure and hospitality, professional and business services, and health care.

Meanwhile, the unemployment rate in the US inched lower to 3.4 percent in January 2023, the lowest level since May 1969 and below market expectations of 3.6 percent. The lowest unemployment since the ‘60s indicates a long way from a recession but reducing the current level of inflation to the target 2% range, needs a continued effort by by the Federal Reserve.

Thus, fears of a recession are always present.

Considering the rally in Stocks so far in 2023, the range for solid dividend paying Stocks are from around 4.6%. First off, consideration must be given to the current yield on the 10-year T-note, which is siting at a 6-week high of 3.8%. Further, consideration must be given to the fact that the Yields on the 10-Year could settle north of 4.5% or even 5.0%.

The yields on Stocks selected should be substantial, maybe at least 5%, Stocks also potentially offer capital appreciation, which Bonds clearly do not. This means that the Equity Market Risk Premium must be at least over 2%, thus the base total return must be 6.0%, yield plus Capital appreciation.

Thus, in analysing potential stock investments there should also be a focus on: valuations, earnings growth, profitability, upwards earnings revisions, and general positive momentum. Once a Stock has been selected from the screened the Stock need to be validated for the certainty to pay dividends and understand why dividends could possibly be at risk.

INTEL (INTC)

Just to take a quick look at Intel, there is the projected dividend of $1.46.

The question is is this an at-risk dividend?

Think of the this in the recent earnings announcement for Q4 22. Earnings fell and INTEL expects a loss in Q1 2023 of 15c per share. Further, INTEL has a high CAPEX spend to remain competitive with AMD and TSMC.

STOCK SCREENING

There are a number of Financial Data Apps which are key to an effective Stock Investment and Screening Strategy

Barchart

Finscreener

Atom Finance

Let’s go on to Stock screening in Barchart, I am a Member of the Barchart Affiliate Program, the Affiliate link above and FINSCREENER. Firstly we must understand the Key Ratios and define what financial data is our focus in Screening to screen.

Formular

The formula for calculating dividend yield is:

Dividend Yield = Annual Dividend Per Share / Current Stock Price

The formula for calculating Payout Ratio is:

Payout Ratio = Annual Dividend Per Share / Earnings per Share

Financial Data

Dividend Yield

Certainty in Dividends

Growth in Dividends

Market Capitalisation

Earnings Growth

So the dividend paying stocks do not have to be the highest-ranked, so they can be offered on a lower Price to Book valuation. The key is for the dividend stocks to have good capacity to pay dividends.

The intent of this article is to shoot for both high yield and safety – two investment characteristics that often contradict each other.

So, let’s go to the two Screens

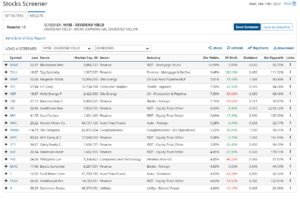

BARCHART

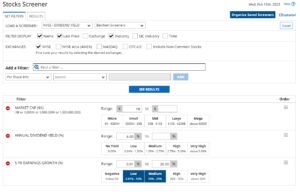

Focusing on Dividend Yield as an Investment Strategy, the criteria used to screen for High Dividend Yielding Stocks listed on the NYSE;

Market Cap

Dividend Yield

Earnings Growth

The result of the Screen indicated 18 stocks

Two Stocks were selected

MMM – 5.8%

MMP – 7.2%

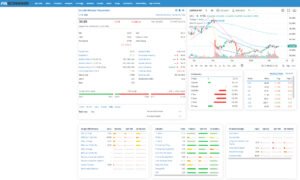

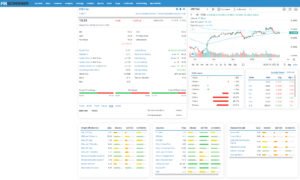

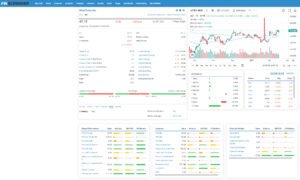

FINSCREENER

The criteria used to screen for stocks with High Dividend Yield as an Investment Strategyin the S&P 500 index;

Dividend Yield

5-Year Growth in Dividends

The result of the Screen indicated 14 stocks

Four Stocks were selected

T – 5.8%, KMI – 5.9%, LNC – 5.%, MO – 8.1%

DIVIDEND INVESTING AS A STRATEGY

Dividend investing as an investment strategy could be important for a number of reasons.

An Investment Alternative

An Investor that prefers Income should look to invest in Stocks other than high-growth Stocks, that has been the investment trend over the past decade. Keep in mind high-growth Stocks require a higher equity market risk premium. If returns do not match expectations, high-growth Stocks will be punished as witnessed in 2022.

Power of Compounding

Reinvesting dividends can increase the value of an individuals Stock Portfolio significantly, boosting growth and returns over time. Thus, Stocks offering a Dividend Reinvestment plan could be of interest.

What is a Dividend Reinvestment Plan?

A Dividend Reinvestment Plan (DRIP) is an investment plan set up by Companies offering shareholders the opportunity to reinvest the announced forthcoming dividend payment in newly issued shares of the company. In order to encourage investors to reinvest in the Company’s Shares the newly issued shares will be offered at a discount to the closing share price on a fixed day. DRIPs offer several benefits to investors, for example compounding their investment and increasing their ownership stake in the company.

Additionally, DRIPs can help investors take advantage of market volatility, as reinvesting dividends can provide a way to buy more shares at a lower price. For companies this offers the opportunity to top up the Share Capital of the company on a regular basis and it does not lead to a Cash Outflow via the payment of a Dividend. Some investors do not like DRIP as they are dilutive as new shares are issued.

A Hedge against Inflation and even Disinflation

Dividend-paying stocks can offer a regular income and in sectors such as Utilities and Consumer Staples, thus offering a cushion when the markets are volatile. Utilities were down only 3% in 2022.

Lower Return Profile

Dividend-paying companies tend have more stable income stream, maybe to be more profitable within their Sector. Companies need to generate sufficient earnings and free cash flow to pay a regular dividend.

Of course, in investing in Dividend Stocks there is still the combination of capital appreciation potential. Higher growth in earning, could lead to dividend growth and dividend yields.

4 Responses

Where you so for a long time were gone?

If I get some interest in how to invest in stocks U.S. I will be back